Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Citigroup boss Jane Fraser has a message for investors: looking after global financial plumbing may not be glamorous but it is highly profitable.

The US lender, which is trying to shed its image as the weakest bank on Wall Street, dedicated its annual investor day this month to talking up its “services” business. One of five newly formed divisions, it helps companies manage and move their money around the world. It also provides trade-finance and securities services like custody.

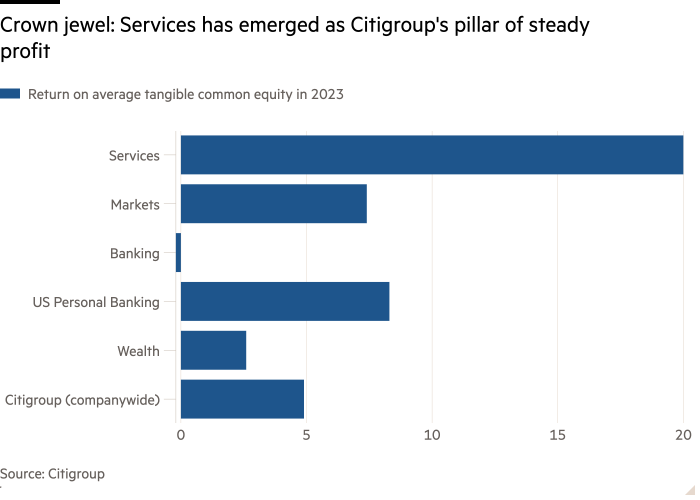

Fraser calls the division Citi’s “crown jewel” — and for good reason. While the business accounted for less than a quarter of the group’s $78.5bn of revenue last year, it generated half of the company’s net income. The unit delivered a return on average tangible common equity of 20 per cent in 2023. That compares with Citi’s overall RoTCE at just 4.9 per cent.

Yet the glint from that jewel cannot disguise the bank’s other blemishes. Its investment banking and wealth management units remain industry laggards. Retail banking is under pressure amid rising funding costs and tepid loan growth.

Citi has forecast that returns from services will rise into the mid-20s in the medium term. Even then, Citi needs a big boost in profitability from its other divisions if it hopes to hit a group target of RoTCE at 11 to 12 per cent by 2026. It is counting on new leadership at the banking and wealth units, plus new products in markets and personal banking, to help lift returns from these four units to around the mid-teens.

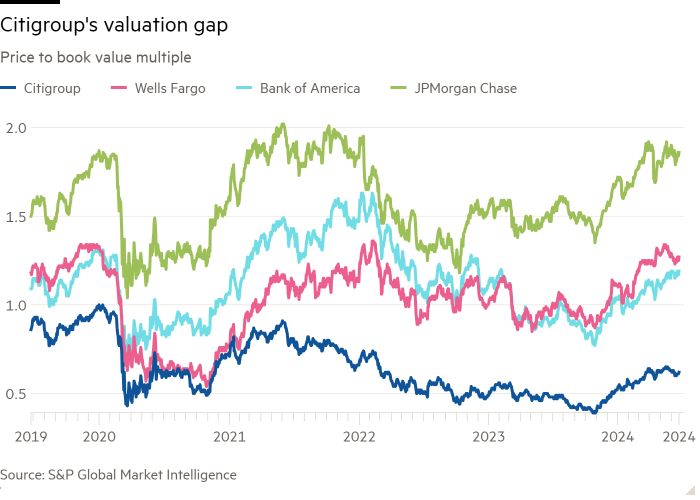

Despite rallying by a third over the past year, Citi shares trade at a lowly valuation of 0.6 times book value. Wells Fargo and Bank of America trade on twice that. JPMorgan is priced at nearly 1.9 times book value.

Since taking the helm in March 2021, Fraser has embarked on a radical restructuring to cut costs. She has exited several overseas retail banking operations, reduced management layers and announced plans to shed tens of thousands of jobs. The goal: to get Citi’s efficiency ratio (cost/income) from 67.3 per cent in the first quarter to under 60 per cent by 2026.

But her ability to cut faces regulatory constraints. Addressing consent orders imposed by regulators in 2020, requiring the bank to improve its internal controls, has kept expenses high. Its non-wage related expense ratio, at 35 per cent last year, was well ahead of the 28 per cent reported by Bank of America and JPMorgan.

The FDIC’s recent rejection of Citi’s “living will” — plan of resolution in a crisis — and the rebuke of the bank’s data controls could keep Citi’s spending spigot open. This Citi turnaround, like all the others, has some way to go yet.