Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Summer plus sports is the magic combination on the UK pub scene. Big events such as the Euro 2024 football tournament trigger enthusiastic forecasts about a sales pop for the nation’s troubled pubs sector. Publicans will take all of the help they can get. A report last week suggested 80 pubs closed a month in the first quarter.

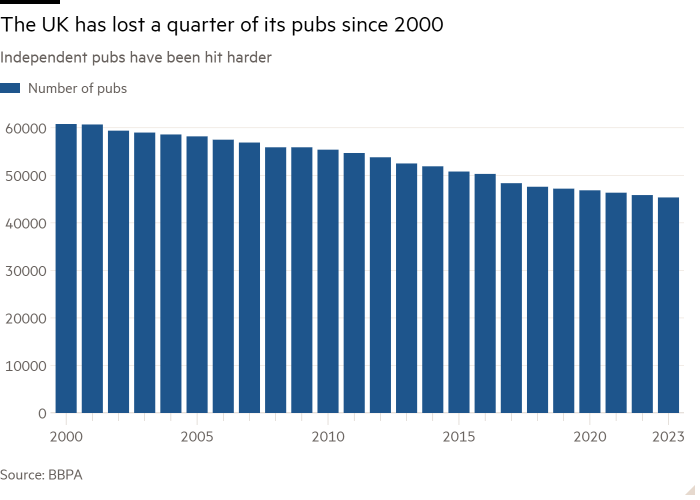

The UK has lost nearly 15,500 — or a quarter — of its pubs since 2000. The decline began long before the pandemic shut bars, as cheap supermarket booze drew customers away. More recently lockdowns, soaring energy and other costs took a toll. Still, it’s not all doom and gloom.

Independent businesses account for a higher proportion of closures, says Emma McClarkin, chief executive of the BBPA trade body. Results from listed pub groups including Young’s and Fuller, Smith & Turner paint a less dismal picture.

Young’s, which owns more than 280 pubs and 1,000 bedrooms, this month reported record annual adjusted pre-tax profit of £49.4mn — up 9 per cent.

At Fuller’s, adjusted full-year profits jumped 61 per cent to more than £20mn. JD Wetherspoon said in May it expected its annual profits to be at the higher end of market expectations, which at the time ranged between £67mn and £75mn. The upper end would mark a 76 per cent improvement on the previous year.

Pub groups have proved adept at adapting to changing consumer trends — catering to coffee drinkers, putting hotel rooms above pubs that are popular with tourists and improving their meals to compete with restaurants.

This improving picture is not always reflected in share price performance or valuations. The net asset value of Young’s is more than 45 per cent above its share price, according to Peel Hunt. Equally, Fuller’s NAV equates to about £14.30 per share. Its shares trade at less than half that, despite a 16 per cent rise in the past 12 months, helped by share buybacks.

Some cost pressures are easing, including food and energy bills. The Labour party has pledged to reform business rates — a long-standing pub industry gripe — if it wins the UK general election on July 4. Investors are nervy about other ideas such as the removal of lower national minimum wage levels for younger workers. But larger pub groups, much as they like to groan about wage increases, manage to adapt — though it would do little to bolster valuations.

The Great British pub will live on, although increasingly its strength will be in numbers.